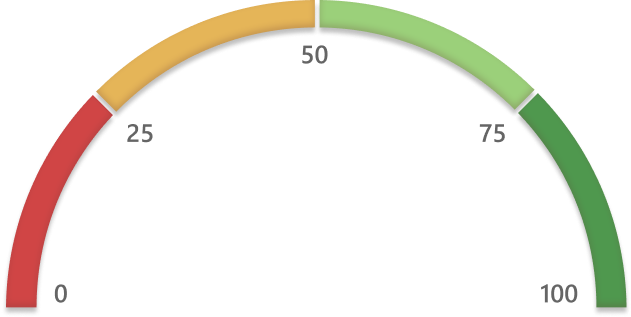

Bitcoin Fear and Greed Index Gauge

Bitcoin Fear and Greed Index Timeline

Bitcoin Fear And Greed Index Corresponding with BTC Price

Stay connected

with BitScreener.

Quickly get a sense of market movement and real-time

data of 10000+ coins by using BitScreener Mobile App.

the app.

Bitcoin Fear and Greed Index FAQs

The Bitcoin Fear And Greed Index is an indicator that measures the overall crypto market sentiment, based on the current sentiment of the Bitcoin market. The Index is a variation of the original index developed by CNN Markets which gauges the sentiment of the stock market.

The logic of this theory depends on the two predominant human emotions that can affect investor behavior: Fear and Greed.

- People often feel fearful when the market is down, driving the prices down further. Hence, fear is seen as a buy indicator.

- Meanwhile, people tend to get greedy when the market is up, pushing the prices up higher. This can result in FOMO (Fear of missing out) which forces you to make irrational trading decisions for fear of missing out on a potential opportunity. So, greed is often seen as a sell.

Therefore, being aware of the market sentiment with the Bitcoin Fear and Greed Index gives us a clue on the right time to enter or exit a position, and save us from our emotional decision-making.

In order to show a meaningful progression in the sentiment change of the cryptocurrency market, each data point is valued at the same level as the day prior.The index takes only Bitcoin into account since Bitcoin accounts for the majority of the market volatility. To calculate the score of the index, we extracts data from the following sources:

- Market Volatility (25%): Comparing the current value of Bitcoin volatility to its average value over the last 30 days and the last 90 days. A rise in volatility indicates a fearful market.

- Market Momentum/Volume (25%): Comparing the current values of Bitcoin volume and momentum to its average values over the last 30 days and the last 90 days. A high buying volume in a positive market signals a greedy market.

- Social Media (15%): Gathering and counting posts for Bitcoin via hashtags on social media and measuring the interaction rate (the pace and amount of social media interactions) for the coin. A high interaction rate shows an increased interest in the coin, thus signaling a greedy market.

- Surveys (15%): This index currently does not gather data from polls and surveys.

- Dominance (10%): Reflected in Bitcoin’s presence or market cap share of the entire crypto market capitalization. A decrease in Bitcoin dominance means a reduction in Bitcoin investment, indicating that people are getting greedy by investing in more risky altcoins, instead of safer Bitcoin.

- Market Trends (10%): Analyzing data of search trends for various relevant Bitcoin search queries.

| Zones | Explanation |

|---|---|

| 0 to 24: Extreme Fear | High extreme fear suggests a good time to open fresh positions, as markets are likely to be oversold and might turn upwards. |

| 25 to 49: Fear | It suggests that investors are fearful in the market, but the action to be taken depends on the Bitcoin Fear and Greed Index trajectory. If it is dropping from Greed to Fear, it means fear is increasing in the market & investors should wait till it reaches Extreme Fear, as that is when the market is expected to turn upwards . If Bitcoin Fear and Greed Index is coming from Extreme fear, it means fear is reducing in the market. If not best, might be a good time to open fresh positions. |

| 50: Neutral | The market seems stable but they are gonna change soon. Be careful with your choice now. |

| 51 to 74: Greed | It suggests that investors are acting greedy in the market, but the action to be taken depends on the Bitcoin Fear and Greed Index trajectory. If Fear is coming Neutral towards Greed zone, it means greed is increasing in the market and investors should be cautious in opening new positions. If Bitcoin Fear and Greed Index is dropping from Extreme Greed, it means greed is reducing in the market. But more patience is suggested before looking for fresh opportunities. |

| 75 to 100: Extreme Greed | High extreme greed suggests investors should avoid opening fresh positions as markets are overbought and likely to turn downwards |

Bitcoin Fear and Greed Index can help investors recognize the market sentiment and make informed trading decisions, based on two simple assumptions:

- A lower score indicates that investors are fearful, which means that there is an increase in selling pressure, causing the market to fall further. Therefore, this presents a buying opportunity for investors.

- A higher score indicates that investors are getting greedy and buying more, driving the market up higher. Hence, this offers a selling opportunity.

The Index can be a useful tool to provide investors with an overall perspective of the market in a certain period. However, the index does not gauge any certain prediction for future prices, given the volatile nature of the crypto market.

The Index gathers data from different timeframes: daily, weekly, monthly, and yearly, so it can suit investors with different time horizons. A day trader or cyclical investor can add the Index to their trading strategy.

As soon as the new data is available!